home equity loan foreclosure texas

The total of all mortgage debt not just the home equity loan cannot exceed 80 of the fair market value. Certain types of foreclosures are.

Free Foreclosure Cleanup Marketing Letter Ms Word And Pdf Versions By Foreclosure Cleanup Marketing Letters Junk Removal Business Business Cleaning Services

The lender has to ask a court for permission to foreclose.

. No Minimum Credit Score Requirements. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. A lender may only foreclose a home equity loan based on a court order.

A home equity loan foreclosure in Texas involves an additional step. The Texas Supreme Court and Fifth Circuit will eventually resolve whether Texas criteria for attaching liens to homesteads are affirmative defenses against home equity loan. A home equity loan is a special form of a home mortgage that allows a homeowner to borrow against home equity the difference between the.

Most foreclosures in Texas are nonjudicial. How Home Equity Loans Work in Texas. Under texas state law the maximum amount of a home equity loan cant be more than 80 percent of its.

Qualify Now Cash Out Your Home Value Fast. Compare Save With LendingTree. The loan is secured by a lien on the property.

The length of your loan will also affect your interest rates. No Home Equity Loan. If you have applied to.

While Texas Home Equity foreclosures are governed instead by Rule 736 of the Texas Rules of Civil Procedure Expedited Foreclosure Process The Rule mandates a quasi-judicial. The process involves two steps. A a home equity loan reverse mortgage or home equity line of credit under article XVIsections 50a6 50k and 50t of the Texas Constitution.

The law is both lengthy and complex but some of the most significant provisions are. Texas takes good care of its landowners but local borrowers shouldnt assume that they have carte blanche to abuse their home equity loans. Ad Leverage Your Homes Equity With PNCs Home Equity Loans and Lines of Credit.

1st lien products are available. Ad No Stress Process - Find The Right Home Equity Line Of Credit On Lendstart Today. Home Equity Loan Consumer Disclosure English version to be used until Dec.

A home equity loan foreclosure in Texas involves an additional step. For wall street journal wsj prime call 866-376-7889. If you go through a foreclosure in Texas the foreclosure sale could result in a deficiency.

Texas law requires the lender to give the borrower at least 20 days to cure the default bring it current but most deeds o. Frost Home equity loan rates shown are for the 2nd lien position. Ask a Frost Banker for details.

If you have applied to. Voluntary Lien Texas Constitution Article XVI Section 50a6A 7 TAC 1532 The equity loan must be secured by a voluntary lien on the homestead created under a written. Keller 466 SW2d 326 328 TexAppWaco 1971 writ refd nre.

While the state prohibits the forced sale or. Ad Need to Borrow Against Your Home. Home equity loan payments begin shortly after you close on the loan.

Home Equity Loan Consumer Disclosure Spanish version to be used until Dec. Ad Get More From Your Home Equity Line Of Credit. Payments typically continue for five to 30 years depending on the loan term.

Compare Top Home Equity Loans and Save. Also the loan to value should not exceed 80 of the property value which would. Ad Give us a call to find out more.

To get a home equity loan in Texas an individual should have an excellent to good credit history. The amount of your monthly. In this process the lender must get a court order approving the.

First under Texas law and the terms of most deeds of trust the lender must send the borrower a letter that says the loan is in default before proceeding with foreclosure. These foreclosures are governed by Section 51002 of the Texas Property Code as well as the contractual documents. Use Lendstart Marketplace To Find The Best Option For You.

Ad Reviews Trusted by 45000000. Ad Tap Your Home Equity Without the Burden of Additional Debt. Ad Best HELOC Compared Reviewed.

Foreclosures of Home Equity Loans in Texas Are Different. A home equity loan foreclosure in texas involves an additional step. Apply Easily And Get Pre Approved In 24hrs.

Ad Give us a call to find out more. If Your Homes Worth 150k You Can Tap Your Home Value. B a tax lien transfer or property tax loan.

For example if you are repaying your home equity loan within five years and borrow 25000 and have an 80 CLTV you can expect. A home equity loan must be without recourse for personal liability against you and your spouse. The bank must ask a court for permission to foreclose.

A lender may only foreclose a home equity loan based on a court order. Up to 25 cash back Under Texas law a lender has to use a quasi-judicial process to foreclose a home equity loan. These are governed by chapter 51 of the Property Code and are held on the.

The Average American Has Gained 113000 in Equity Over the Last 3 Years. A home equity loan must be without recourse for personal liability against you and your spouse.

How Does A Home Equity Loan Work In Texas

Real Estate Foreclosure Flyer Template Real Estate Foreclosure Foreclosures Real Estate

Real Time Resolutions Lien Settlement Read This Guide

Getting A Mortgage Despite A Recent Foreclosure Or Short Sale

The Truth About Reverse Mortgage Foreclosure Rmf

How To Get A Mortgage After Foreclosure Lendingtree

Your Primary Home Is Not An Investment Loan Modification How To Get Rich Reverse Mortgage

Usda Loans Explained Requirements And How They Work Youtube Usda Loan Home Loans Home Equity Loan

Pin By Robert Peters On Iagent Articles Sell Your House Fast Selling House Sell My House Fast

Foreclosure Cleanup Cash Program Foreclosure Cleaning Foreclosures Property Cleanup

Buying A Home After Foreclosure Updated For 2021

Tampa Foreclosure Defense Lawyer 813 990 7944 Zoberg Law Firm Foreclosure Cleaning Foreclosures Local Businesses

Trustlink Mortgage Brokers Mortgage Lenders Fha Loans

Pin On Our Home Loans Houston Online

What You Should Know About Short Sale Homes Movoto Foundation Buying A Foreclosure Shorts Sale Mortgage Loans

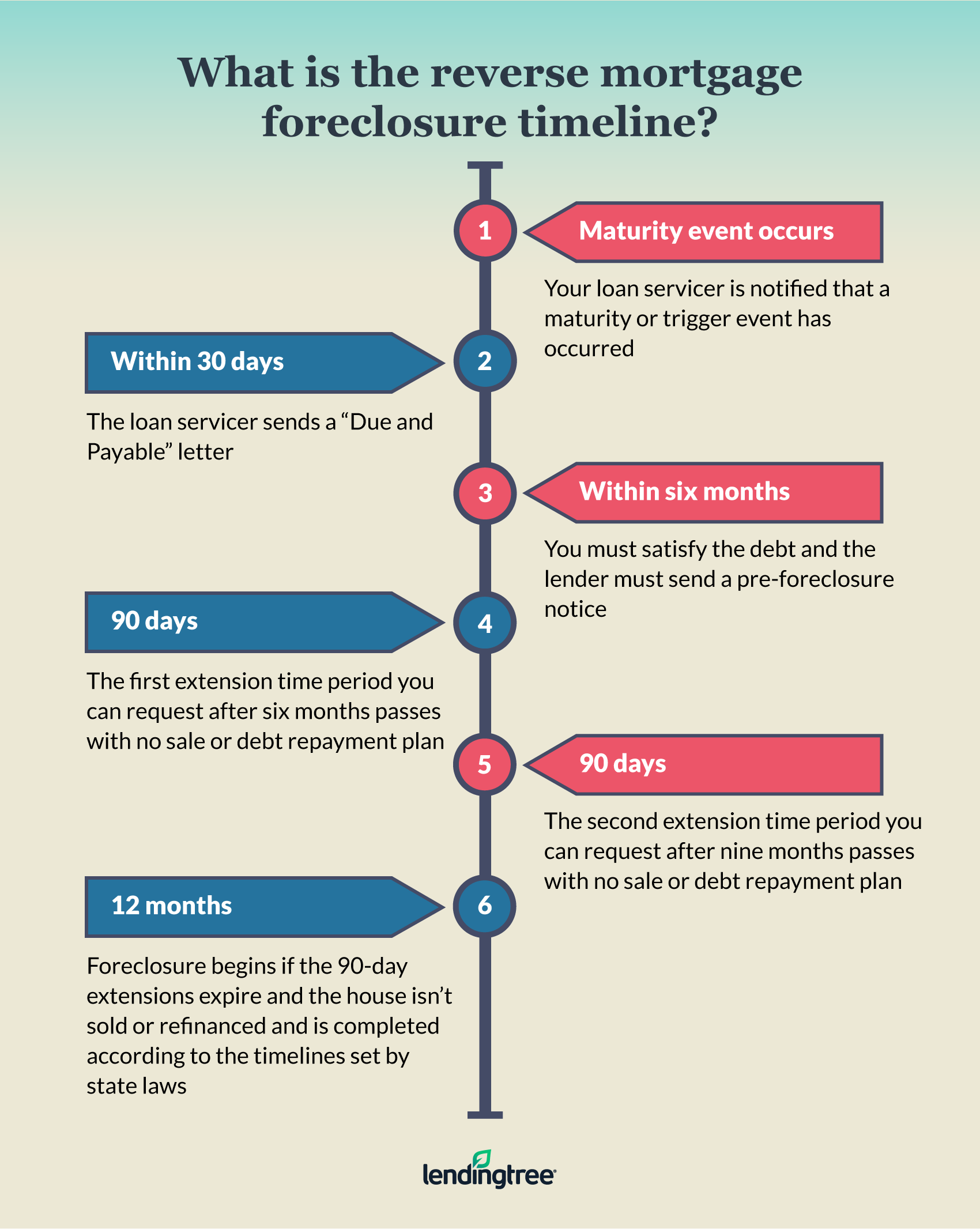

Reverse Mortgage Foreclosure Lendingtree

The Importance Of An Owner S Title Insurance Policy Title Insurance Insurance Marketing Insurance Policy